Supreme Court of British Columbia rules on Tax Refunds in Bankruptcy. In a decision released December 14, 2023, the Supreme Court of British

Student Loans – Single Date Approach

May 2023 BC Court of Appeal confirms single date approach to discharging Student Loans through a consumer proposal or bankruptcy. A recent

Can I Pursue an Undischarged Bankrupt for Collection?

Yes you can. However, you must wait until the Licensed Insolvency Trustee is discharged. When a person goes into bankruptcy a Stay of Proceedings

Insolvency Searches

Recently the Office of the Superintendent of Bankruptcy (“OSB”) announced that it is modernizing its Insolvency Record Search function including the

David Wood voted Top Three Licensed Insolvency Trustee

David Wood is pleased to have been selected as one of the Top Three Licensed Insolvency Trustees in Vancouver BC., for the second year in a row by

Boale, Wood & Company Ltd. News

Tracey Stewart The partners at Boale, Wood & Company Ltd. are pleased to announce that Tracey Stewart recently passed the Insolvency

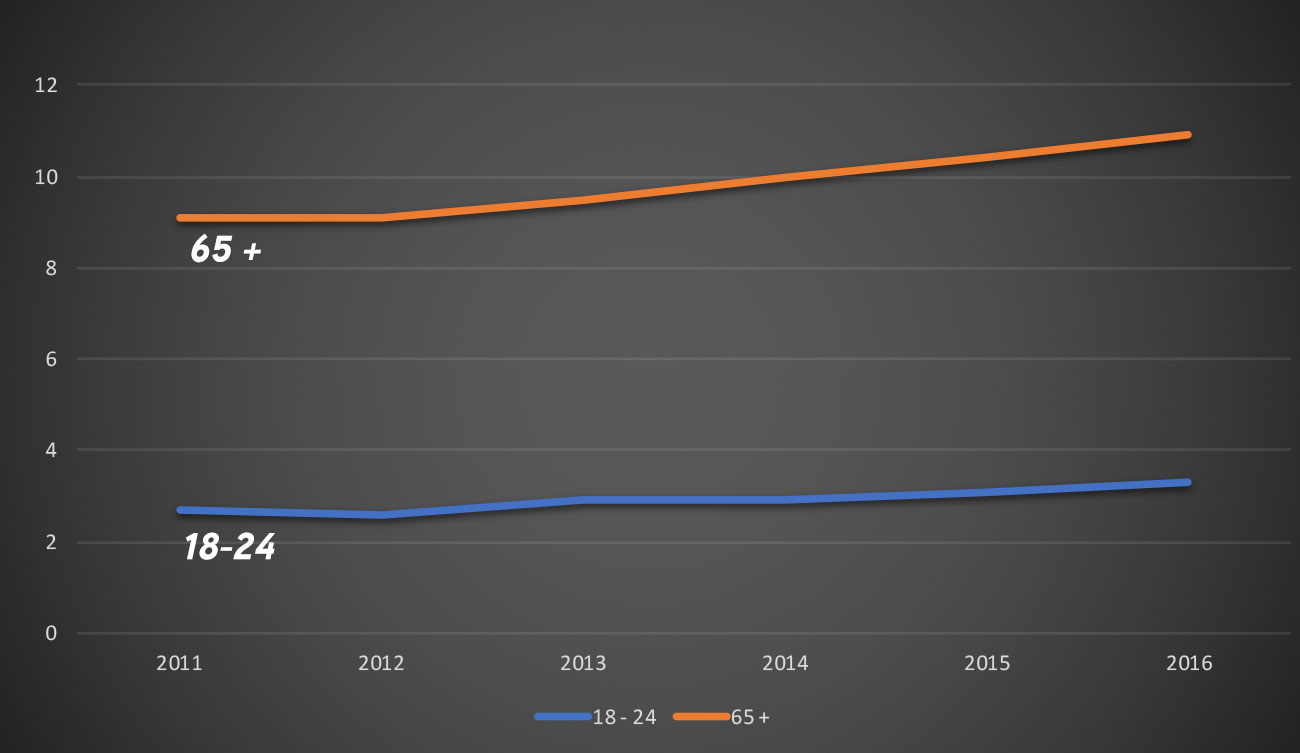

OSB Issues Report on 10 Year Insolvency Trends

The Office of the Superintendent of Bankruptcy recently issued a report on Ten-Year Insolvency Trends in Canada. The ten year period covers 2007 –

Canadian Economy Slowdown

Headline: Somebody forgot to tell employers that Canada’s economy is slowing down. Via: The National Post

Growth Slower in 2018

Headline: Slower growth for Canada in 2018. Via: Advisor.CA