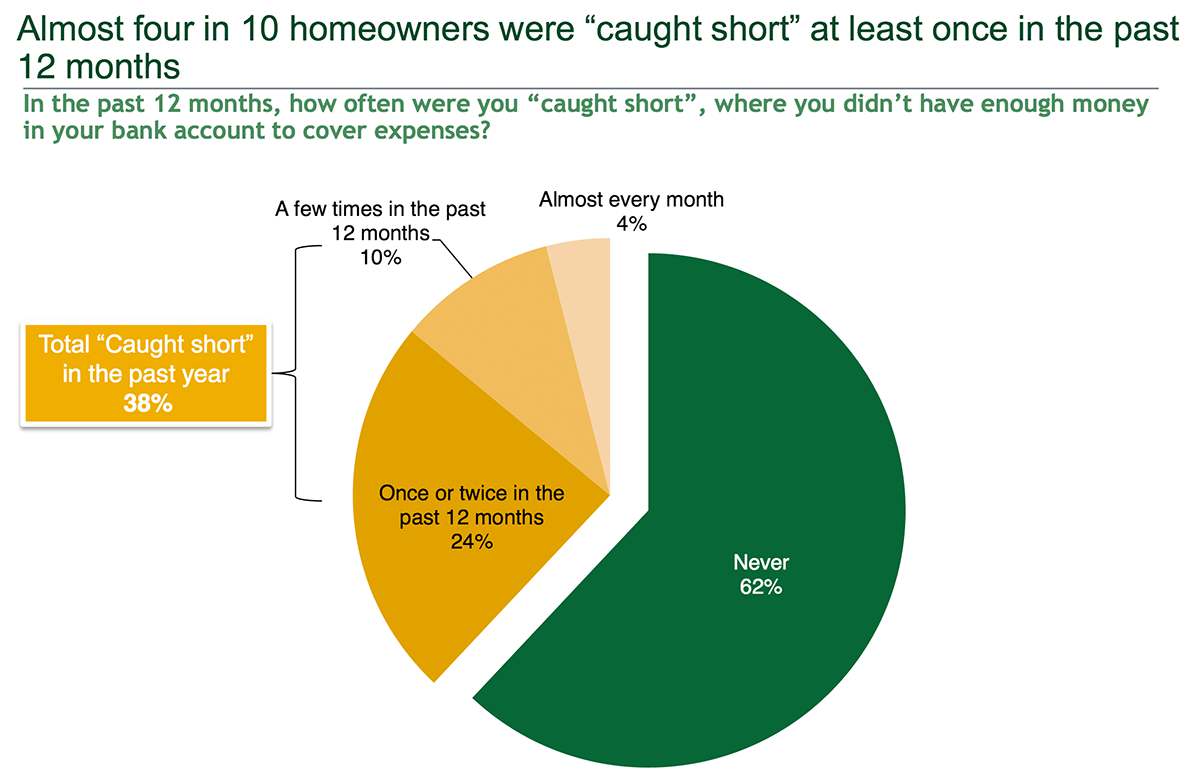

A new survey from Manulife Bank indicates that 40% of Canadians didn’t have enough money to cover expenses in the last 12 months, and had to turn to credit to cover bills.

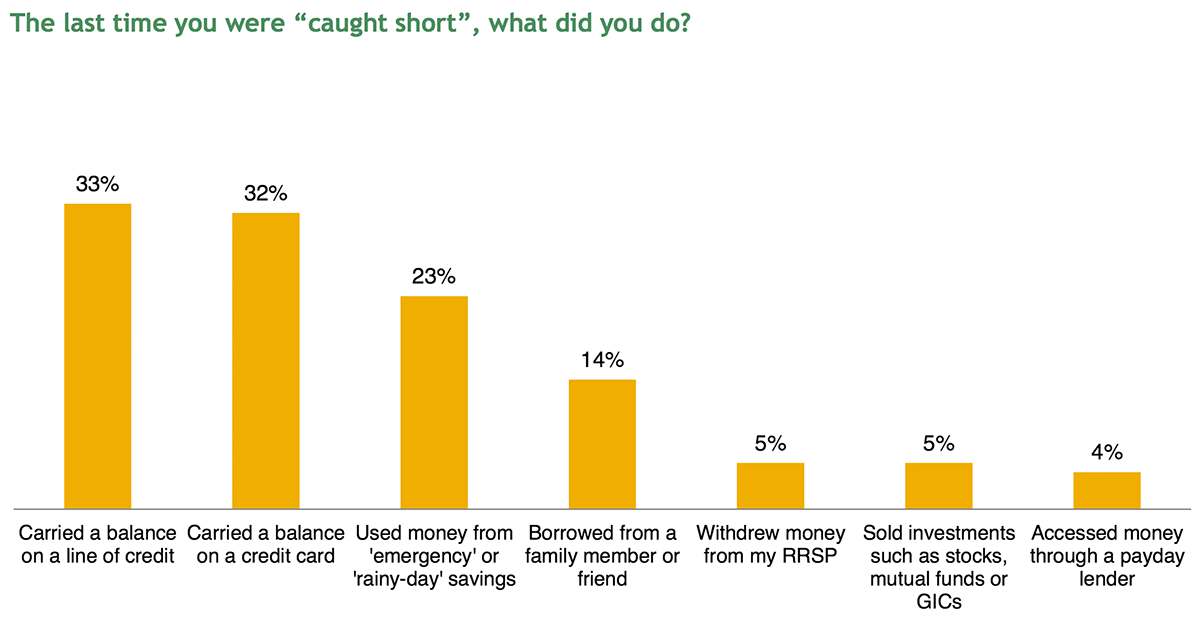

The Manulife Bank Homeowner Debt Survey says that “Line of Credit and Credit Card were the most common source of funds for homeowners who were “caught short” in the past 12 months”.

It also reports that mortgage debt is highest among homeowners between 30 and 39 years old and those living in Alberta and B.C.

You can see the full report from Manulife here.