Supreme Court of British Columbia rules on Tax Refunds in Bankruptcy. In a decision released December 14, 2023, the Supreme Court of British

Debt Solutions Portal

Information Rich On-line Resource to Help Canadians The Office of the Superintendent of Bankruptcy (OSB) has created a series of articles and

Student Loans – Single Date Approach

May 2023 BC Court of Appeal confirms single date approach to discharging Student Loans through a consumer proposal or bankruptcy. A recent

Credit Cards Rewards – Honest Mistake or ?

Recently I had to call my credit card company for a new credit card as my card was delaminating and the tap function was no longer working. While

Beware of the Online Calculator

There are a lot of online calculators that will calculate whether you qualify for a consolidation loan, what your credit card payment will be and

A Closer Look at September 2022 Insolvency Stats

Consumer insolvencies in BC increased in September 2022 overall by 33.5 percent from September 2021. Consumer proposals increased 52.9 percent

OSB Issues Consumer Alert

If it sounds too good to be true, it probably is. The Office of the Superintendent of Bankruptcy has issued a News Release/Consumer Alert

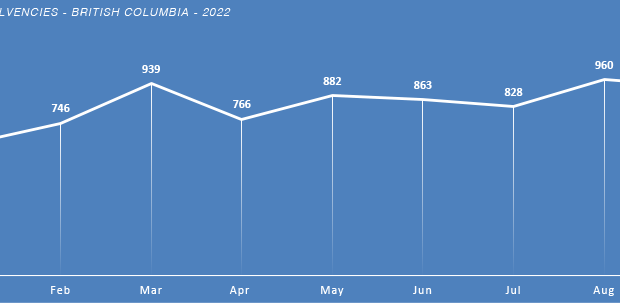

A Closer Look at August 2022 Insolvency Stats

Consumer insolvencies in BC increased in August 2022 overall by 33.4 percent from August 2021. Consumer proposals increased 44.0 percent while

CRA Ramps up Collections on CERB

Have you received a repayment letter from CRA and don’t have the funds? You’re panicking because you don’t know where the money is coming from. Don’t