In a report titled “Household Indebtedness and Financial Vulnerability”, the Parliamentary Budget Officer says among G7 countries, Canada has experienced “the largest increase in household debt relative to income since 2000”.

The report reviews ‘the evolution of household indebtedness in Canada’ over the medium term.

Among its findings:

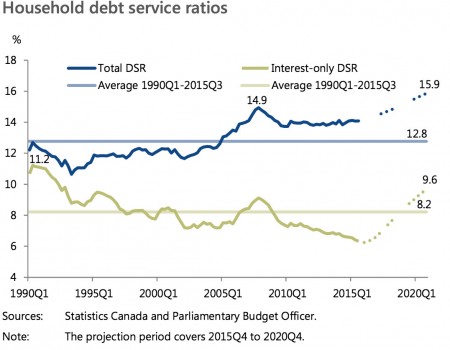

The indebtedness of Canadian households continues to trend higher. In the third quarter of 2015, total household debt (i.e., credit market debt plus trade payables) reached 171 per cent of disposable income. In other words, for every $100 of disposable income, households had debt obligations of $171. This is the highest level recorded since 1990.

- Among G7 countries, Canada has experienced the largest increase in household debt relative to income since 2000. Households in Canada have become more indebted than any other G7 country over recent history.

- Measured relative to household assets, household debt has moderated in recent years. In the third quarter of 2015, household debt accounted for 17.0 per cent of household assets. But this was still above the average of 15.4 per cent prior to the global financial crisis.

- Analysis conducted at the Bank of Canada suggests that low interest rates, higher house prices and financial innovation have contributed to the increase in household indebtedness.

You can read the full report here.

Also see :

- Globe and Mail story about this issue.

- Vancouver Sun story.