-

Tax Refunds in Bankruptcy

Continue reading »

Supreme Court of British Columbia rules on Tax Refunds in Bankruptcy.

In a decision released December 14, 2023, the Supreme Court of British Columbia ruled that any tax refunds that a bankrupt may be entitled to prior to bankruptcy, due to the application of a Disability Tax Credit, vest in the Trustee and that the tax refunds are properly considered an asset of a bankrupt.

In the case of Re: Lynk, the bankrupt challenged the right of the Trustee to retain any tax refunds that pre-dated the bankruptcy, that were received as a result of the bankrupt applying for, and being approved for, a Disability Tax Credit (“DTC”) on her annual tax returns. The Court also stated that the application of the DTC is not a refund itself, as many refer to it as, but a non-refundable tax credit that reduces an individual’s taxable income which may be applied to that person’s taxable income. The application of the DTC gives rise to a Tax refund, not a “Disability Refund”. Nothing more, nothing less.

The result of this case also confirms the correctness of the Position Paper published by the Office of the Superintendent of Bankruptcy that states that any tax refunds that arise as a result of the application of the Disability Tax Credit are property of the Bankrupt.

The takeaway is that DTC’s are not refunds. They are tax credits that, when applied, may give rise to a tax refund. But a DTC in itself is not a refund as so many term it as. It further confirms that tax refunds for years that pre-date the bankruptcy are property of the bankrupt and vest in the Trustee.

-

Debt Solutions Portal

Continue reading »

Information Rich On-line Resource to Help Canadians

The Office of the Superintendent of Bankruptcy (OSB) has created a series of articles and videos to help consumers's identify reliable sources of debt assistance.

OSB and the Canadian Association of Insolvency and Restructuring Professionals (CAIRP) are working together to help Canadians find advice and solutions they can trust to help with their debt.

You can access the portal for free here.

Here are some direct links to articles:

- How to spot sketchy debt advice. Read the article here.

- How to avoid paying unnecessary fees on your debt. Read the article here.

- Money tips to improve your financial health. Read the article here.

Video and audio:

- Worried about your debt? Video and audio here.

Contact us to discuss your situation over the phone, a video chat, or in-person. You will talk directly to a Licensed Insolvency Trustee.

Call Us. It's Not Too Late!

(604) 605-3335

Boale, Wood & Company Ltd. – Licensed Insolvency Trustee

Boale, Wood & Company Ltd. is a Licensed Insolvency Trustee that has been around since 2004. We are local experienced insolvency practitioners who have a hands-on approach to your situation. We understand the personal impacts of major financial stress. We offer free consultations to review your financial situation and practical debt resolution options.

-

Student Loans – Single Date Approach

Continue reading »

May 2023

BC Court of Appeal confirms single date approach to discharging Student Loans through a consumer proposal or bankruptcy.

A recent decision by the BC Court of Appeal confirmed that BC will continue to follow the single date approach when considering whether or not a Student Loan is dischargeable through either a consumer proposal or a bankruptcy.

In the recent decision of Re: Piekut (2023 BCCA 181) the Court declined to change the single date approach to a multiple date approach when considering if Student Loans are discharged in either a consumer proposal or bankruptcy and continued to follow the current jurisprudence that was established in 2015 in the BC Decision of Re: Mallory (2015 BCSC 5).

Background

Currently, the Bankruptcy and Insolvency Act (“BIA”) legislation provides that if a bankrupt ceases to be a student within seven years of the filing of a bankruptcy, the debt will not be discharged at the end of the bankruptcy. This section also applies to individuals who have filed proposals.

If it has been greater than seven years from the date of a bankruptcy or a proposal, then the debt would be dischargeable.

We understand that Student Loans Regulations considers the End of Study date to be when an individual ceased or ceases to be a student. This date doesn’t mean the last day you attended school. It is the date that the government considers to be the last date of the program you were last enrolled in. It also includes both full-time and part-time attendance.

A student loan may be discharged if the student makes a “hardship” application to have the student loan discharged in a bankruptcy or proposal. The criteria is that more than five years has elapsed post-study but less than seven years has elapsed from the filing of the bankruptcy or proposal (more on that later in a subsequent paper).

The debtor in this case raised the issue of whether the BC should continue to use a “single date” approach as decided in Mallory or a “multiple date” approach when determining whether a student loan is discharged under s. 178(2) of the BIA which has been adopted in other jurisdictions.

The Court of Appeal rejected the multiple date method of determining when an individual ceased to be a student and confirmed that Mallory was of sound reasoning. It also stated that decisions in other jurisdictions decided subsequent to Mallory that adopted the multiple date method didn’t identify any error in the Mallory analysis and did not find them persuasive despite having a different outcome. It stated that decisions in other jurisdictions did not adequately consider the structure and the language of S178(1)(g) nor the differences between the English and French versions of the BIA.

So the question is, “Does a student who is in-and-out of school, with or without student loans for each (or any) session, reset the clock each time they enroll in subsequent studies”.

For example, if you file a bankruptcy or proposal and have student loans that are more than seven years old, but in the meantime, have gone back to school and self-funded those studies, within seven years of the insolvency filing, when have you ceased to be a student. Is it from the time you ceased to be a student on the first loan, or when you went back to school on the self-funded studies.

In BC the Court of Appeal confirmed that indeed the clock does reset as decided in Mallory and confirmed in Piekut. The end result is that the student loan survived the proposal and was not discharged under the BIA.

There has been no word on whether leave to the Supreme Court of Canada will be sought.

If you have Student Loan debt that is unmanageable, contact us today. We offer a free no-obligation consultation where we will look at all your debts with you and help you decide if a bankruptcy or consumer proposal makes sense to deal with your student debt.

A virtual meeting is available via Zoom or Microsoft Teams. Or we can chat on the phone or by email. If you would like an in-person consultation, we can arrange that as well. We have offices in Vancouver and Surrey.

Call us. It’s not too late!

(604) 605-3335

www.boalewood.ca -

Credit Cards Rewards – Honest Mistake or ?

Continue reading »

Recently I had to call my credit card company for a new credit card as my card was delaminating and the tap function was no longer working.

While speaking to the credit card agent, I just happen to notice that my rewards number had been changed on my statement. Not at my request. There was no reason to change the number as I had been a member of that rewards program pretty well since its inception.

After reviewing my statements, it turns out that my rewards number had been changed for over three months. I had called the credit card company three months previously to clarify a charge on the statement. However, at no time was there any discussion about changing my rewards number. There would be no reason for it. And when subsequent statements came, I didn’t check the number.

While speaking to the agent about the new card I requested, they changed the number back to the correct one and they told me that the points that were credited to the other rewards number would be credited back to my rewards program on the next statement.

Three months passed by and there had been no credit for the missing points. When I called in again, I received a totally different story about how I was supposed to obtain the lost or missing rewards. I was asked to call the rewards program and have them merge the points from the two accounts. Except that, the other number wasn’t mine and I’m sure whosoever number it was didn’t want to lose their points. I just wanted credit for the points I had earned. In other words, the credit card company didn’t want to admit a mistake and wanted me to do all the work to fix it. I held firm that this was their mistake, and it was up to them to fix it.

After what seemed like an eternity of going back and forth, and the agent putting me on hold to talk to the supervisor, twice I might add, the credit card company agreed to make a one-time adjustment for the missing points. Same thing I heard previously. It seemed like they were doing me a favour.

On March 10, 2023, I did receive my credit card statement and the points were indeed credited to my rewards account as promised by the credit card company. So, they came through. But not without me pushing for it.The takeaway from this is that you should always check your statement, not just for charges but for other details like your rewards number. Some other useful tips in dealing with these types of issues are;

- Don’t lose you temper and abuse the agent. It’s not their fault and you may not receive the help you need to solve the problem.

- Try not to attribute blame. Just ask for help to find a solution to the issue. Don’t create more problems.

I’m still baffled by how this happened. Was it an honest mistake by the first agent I called or something more sinister as some sort of points redirection scam.

I would like to think that some form of internal inquiry is going on as to how this happened and am I the only one. I know they do record conversations for “training” purposes, but who knows how long they keep them for and if my first call was still available. As imaginations go into overdrive, I keep wondering if there are internal sleuths wearing dark glasses, sitting in secure rooms lurking around corners seeking answers. I’ll never know as the credit card company won’t admit a mistake and won’t share that information. Nonetheless, I received my points back like they said and that’s all I wanted.

No bank or credit card company was harmed in the writing of this article.

-

Beware of the Online Calculator

Continue reading »

There are a lot of online calculators that will calculate whether you qualify for a consolidation loan, what your credit card payment will be and whether you qualify for a consumer proposal to name a few.

This article focuses on the consumer proposal calculator. These calculators are generally run by unlicensed professionals who actually cannot help you file a consumer proposal. They claim to offer debt relief but what the reality is, they simply charge a fee (which most people who need debt relief cannot afford) and then refer the file to a Licensed Insolvency Trustee (“LIT”) whom the consumer has to pay again.

These calculators are misleading and make claims about how much debt can be reduced and what the monthly payment would be. They are designed to fool you into thinking you qualify to file a consumer proposal.

These calculations are generally just wrong and do not reflect the many different factors that are needed to determine whether a consumer proposal is viable and capable of being accepted by your creditors. No two situations are alike.

To be frank, I have never seen a consumer proposal calculator state that you weren’t qualified.A consumer who wishes to file a consumer proposal or a bankruptcy, must use the services of a Licensed Insolvency Trustee. There are no other debt professionals who can assist them. So the people who advertise these calculators have no ability to do anything.

Secondly, they must undergo a full financial assessment by the LIT and disclose their assets, liabilities, and their income. This includes understanding the composition of the debt, whether the debt is secured or unsecured and what types of debt are owed (credit card debt, student loan debt, business debt, taxes, etc).

The takeaway here is that if you are in debt you need to talk to a Licensed Insolvency Trustee. Don’t rely on some mathematical gimmick that’s run by unlicensed professionals who will take your money but cannot help you. The general information provided by these websites that make outlandish claims about debt reduction and monthly payments are simply delaying the process of you knowing what the true options are. By calling a LIT directly, you will save time and money and have the correct information available to make an informed decision.

Boale, Wood & Company Ltd. – Licensed Insolvency Trustee

Boale, Wood & Company Ltd. is a Licensed Insolvency Trustee that has been around since 2004. We are local experienced insolvency practitioners who have a hands-on approach to your situation. We understand the personal impacts of major financial stress. We offer free consultations to review your financial situation and practical debt resolution options.

Contact us to discuss your situation over the phone, a video chat, or in-person. You will talk directly to a Licensed Insolvency Trustee.

-

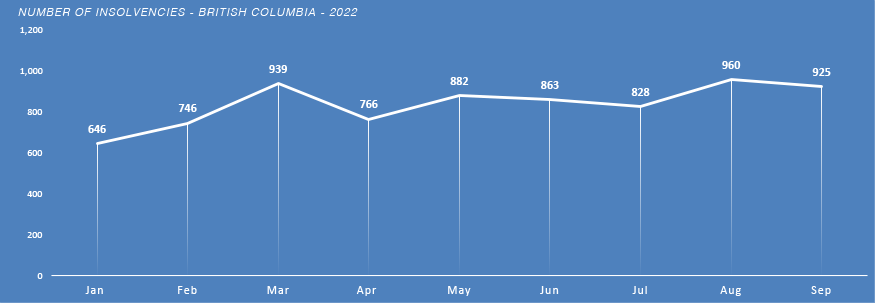

A Closer Look at September 2022 Insolvency Stats

Continue reading »

Consumer insolvencies in BC increased in September 2022 overall by 33.5 percent from September 2021. Consumer proposals increased 52.9 percent while bankruptcies decreased 21.3 percent.

Source: Government of Canada Consumer insolvencies in all of Canada for August increased 22.1 percent over the same period last year. BC accounted for 9.96 percent of all consumer insolvencies in Canada in September 2022.

The proportion of proposals in consumer insolvencies in BC accounted for 84.6 percent of all BC insolvencies September 2022 while they accounted for 76.1 percent for all insolvencies across Canada for the same period.

The proportion of proposals in consumer insolvencies in BC was 77.6 percent during the 12-month period ending September 2022, up from 73.7 percent during the 12-month period ending September 2021. It indicates the popularity of consumer proposals as a way for consumers to deal with their debt and with dealing with a Licensed Insolvency Trustee over other unregulated service providers.

Source: Government of Canada Insolvencies across Canada increased 3.08 percent from August 2022 to September 2022. Bankruptcies increased 1.9 percent and proposals increased by 3.5 percent. Proposals also make up 77.8 percent of all insolvencies for the pervious twelve months, up from 68.3 percent in the previous twelve months.

The insolvency statistics indicate the benefits of the protections provided to consumers under the Bankruptcy and Insolvency Act over other non-legislated options. The filing of a consumer proposal or a bankruptcy comes with legal protections that other service providers cannot give. You are protected by Federal Law.

It also indicates that consumers are seeing the benefits of seeking the professional advice of a Licensed Insolvency Trustee rather than those of other non-regulated service providers.

If you would like to know exact details of how a consumer proposal or a bankruptcy would benefit you in dealing with debt, call us at (604) 605-3335 to schedule a free consultation.

Call us. It’s not too late. -

OSB Issues Consumer Alert

Continue reading »

If it sounds too good to be true, it probably is.

The Office of the Superintendent of Bankruptcy has issued a News Release/Consumer Alert alerting those Canadian Consumers who are in financial difficulty to be aware of unregulated, unlicensed debt advisors that claim to be authorized to assist you with insolvency options.

These firms sometimes charge hundreds or even thousands of dollars for services they are not licensed to provide, or for unnecessary services offered before, during or after a consumer proposal or bankruptcy filing.

The release states that Canadian Consumers meet with a Licensed Insolvency Trustee (LIT). LITs provide independent, unbiased advice about the options to deal with debt. LITs are required to assess your financial and personal situation, and to discuss all options available for solving financial difficulties, including insolvency and non-insolvency options.

Quotes from the news release:Those faced with desperate financial situations are susceptible to false promises of a quick solution to their debt problems. Anyone considering a consumer proposal or bankruptcy should meet with a Licensed Insolvency Trustee first. LITs are the only federally regulated professionals who can provide debt relief options such as bankruptcy and consumer proposals. LITs are bound by a Code of Ethics and required to explore all debt relief options to help debtors find the best solution for their needs.

Elisabeth Lang

Superintendent of BankruptcyCanadians can feel confident that when they seek advice from a Licensed Insolvency Trustee, they are dealing with someone who has demonstrated they have the knowledge, experience and skills to help them make informed choices to deal with their debt. They are the only debt-relief professionals in Canada legally required to offer a complete financial assessment, explain all the options for debt-relief and offer unbiased advice.

Jean-Daniel Breton

Chair of CAIRPYou can read the entire release here.

If you are in debt, you need to call us. It’s not too late. -

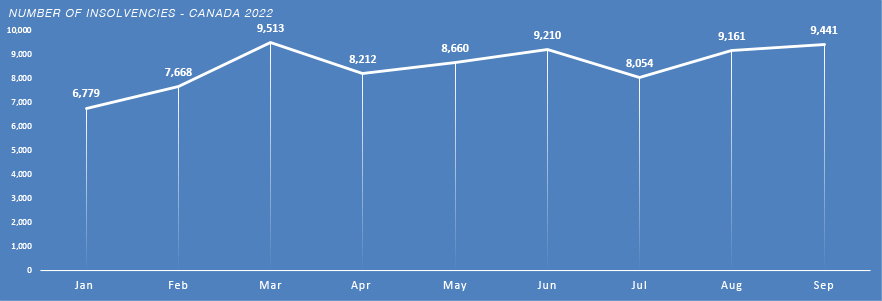

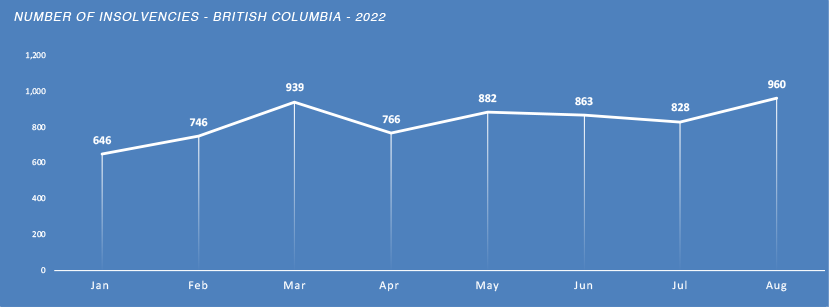

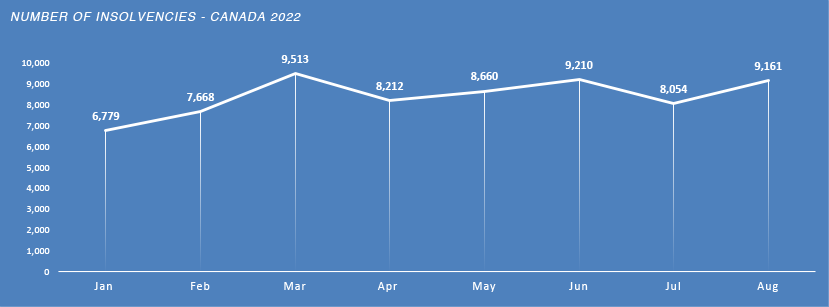

A Closer Look at August 2022 Insolvency Stats

Continue reading »

Consumer insolvencies in BC increased in August 2022 overall by 33.4 percent from August 2021. Consumer proposals increased 44.0 percent while bankruptcies decreased 0.6 percent.

Source: Government of Canada Consumer insolvencies in all of Canada for August increased 26.7 percent over the same period last year. BC accounted for 10.6 percent of all consumer insolvencies in Canada in August 2022.

The proportion of proposals in consumer insolvencies in BC accounted for 82.3 percent of all BC insolvencies August 2022 while they accounted for 75.9 percent for all insolvencies across Canada for the same period.

The proportion of proposals in consumer insolvencies in BC was 80.0 percent during the 12-month period ending August 2022, up from 73.2 percent during the 12-month period ending August 2021. It indicates the popularity of consumer proposals as a way for consumers to deal with their debt and with dealing with a Licensed Insolvency Trustee over other unregulated service providers.

Source: Government of Canada Insolvencies across Canada increased 13.6 percent from July 2022 to August 2022. Bankruptcies increased 9.8 percent and proposals increased by 14.8 percent. Proposals also make up 77.33 percent of all insolvencies for the pervious twelve months, up from 68.03 percent in the previous twelve months.

The insolvency statistics indicate the benefits of the protections provided to consumers under the Bankruptcy and Insolvency Act over other non-legislated options, whether that is a consumer proposal or a bankruptcy. It also indicates that consumers are seeing the benefits of seeking the professional advice of a Licensed Insolvency Trustee rather than those of other non regulated service providers.

If you would like to know exact details of how a consumer proposal or a bankruptcy would benefit you in dealing with debt, call us at (604) 605-3335 to schedule a free consultation.

Call us. It’s not too late. -

CRA Ramps up Collections on CERB

Continue reading »

Have you received a repayment letter from CRA and don’t have the funds? You’re panicking because you don’t know where the money is coming from. Don’t panic. We can help.

The government began to verify the payments it sent to almost nine million Canadians through the Canada Emergency Response Program (CERB). A lot of Canadians are being told they have to pay back some or all of the money they received as the government has determined they were ineligible for the amount received and/or because they received an advance payment that was never reconciled.

The CRA said they have started sending out Notices of Redetermination, or more correctly put, collection notices, to Canadians who turned out to be ineligible for some or all of the CERB they received.

Ignoring the CRA is never a good way at dealing with taxes, whether it be repayment of CERB or just personal income taxes. CRA can seize your bank account or garnish your wages. That could have a huge impact on your life when the money you have for rent and food is suddenly gone.

So now what? Call us. We can help you. The most important thing you can do is ask for help if you need it. Being in debt and struggling just to meet living expenses during high inflation is more common than you think. It’s not too late to seek professional help and find out what your options are.

Call us. It’s not too late!

Boale, Wood & Company Ltd.

(604) 605-3335

Phone: (604) 605-3335 Toll Free: (888) 850-6585