Consumer insolvencies in BC decreased overall by 10.0 percent from September, 2016. Consumer proposals decreased 14.8 percent while bankruptcies decreased 2.6 percent.

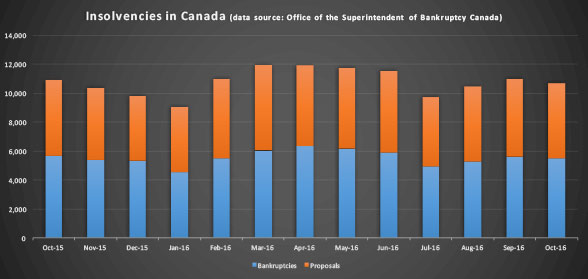

The proportion of proposals in all consumer insolvencies in BC decreased to 57.3 during October while they account for 56.0 percent of all 2016 insolvencies.

Consumer insolvencies in BC for the 12-month period ending October, 2016, decreased overall by 3.4 percent compared with the 12-month period ending October, 2015. Consumer bankruptcies decreased by 14.6 percent, while consumer proposals increased by 7.9 percent.

The increase in the percentage of consumer proposal filings shows the increasing popularity of dealing with debt over bankruptcies and other non-legislated options. It also indicates that consumers are seeing the benefits of using a licensed Insolvency Trustee over other service providers.

The proportion of proposals in consumer insolvencies in BC was 55.8 percent during the 12-month period ending October, 2016, up from 49.8 percent during the 12-month period ending October, 2015. Again, it indicates the popularity of consumer proposals as a way for consumers to deal with their debt over bankruptcies and other non-legislated options.

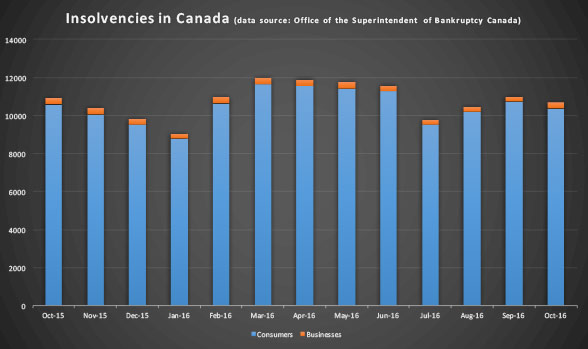

For the 12-month period ending October, 2016, consumer insolvency filings accounted for 97.1 percent of all insolvency filings.