A new survey by Manulife is again raising flags about the risk Canadians face if mortgage rates were to increase.

The survey released on 23 May shows that:

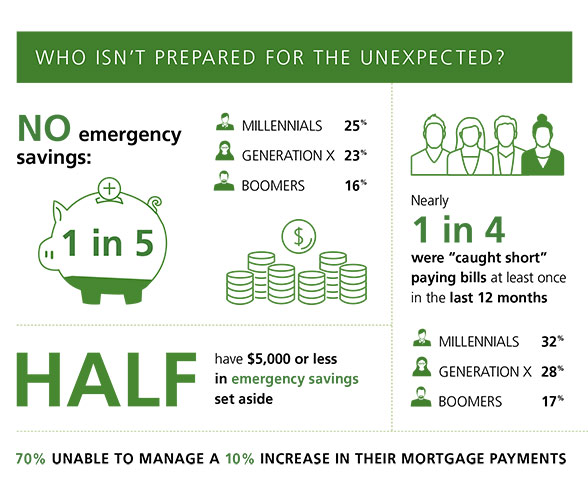

- a significant percentage of Canadian homeowners lack the financial flexibility to adjust to rising interest rates, unexpected expenses or interruption of income,with Millennials most at risk

- One in four Canadian homeowners have not had enough money on hand to pay bills once in the last 12 months while one in five are unprepared for a financial emergency

- Average mortgage debt is up 11% to $201,000

- 70 per cent of mortgage holders are not able to manage a ten per cent increase in their payments. Half (51 per cent) have $5,000 or less set aside to deal with a financial emergency while one fifth have nothing.

The survey goes on to say that the problem is most accute for millenials who’ve seen their mortgage debt rise more than any other generation. They are most likely to have difficulty making a mortgage payment in the event of an emergency, or if say a primary earner becomes unemployed.

“The truth about debt in Canada is that many homeowners are not prepared to adjust to rising interest rates, unforeseen expenses or interruption in their income,” says Rick Lunny, President and Chief Executive Office, Manulife Bank of Canada. “ However, building flexibility into how they structure their debtcan help ease the burden.

Further details on the Manulife debt survey are here.