The Office of the Parliamentary Budget Officer has released a new report titled: Household Indebtedness and Financial Vulnerability – Recent Developments and Outlook.

The report focuses on DSR – debt service ration. This is the capacity of households to service their debt.

-

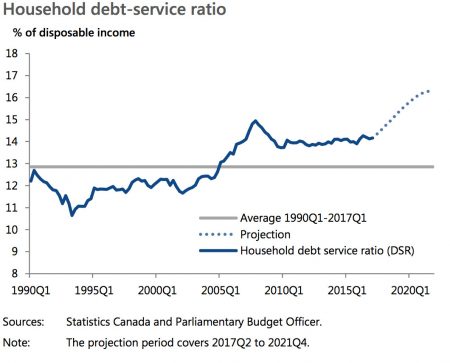

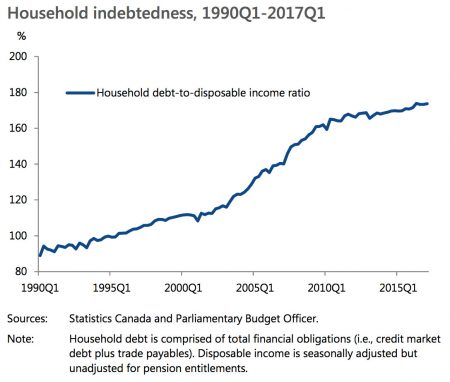

The DSR remained relatively stable around 14.0 per cent from early 2009 through the first half of 2015. Even though household debt increased from 158 per cent of disposable income to 170 per cent over this period, lower borrowing rates offset the impact of this additional debt on total obligated payments.

-

Since mid-2015, the DSR has edged slightly higher, reaching 14.2 per cent in the first quarter of 2017. At the same time, the interest-only DSR has continued to trend lower as household borrowing rates have stabilised at historically low levels. This suggests that increased household indebtedness is no longer being offset by lower borrowing rates.

The report says that:

Looking ahead, the extent to which households will become more financially vulnerable will ultimately depend on their debt-servicing capacity, and therefore on the evolution of interest rates and household indebtedness. Despite a projected rise in interest rates, we expect household indebtedness to increase due to continued gains in real house prices and elevated levels of consumer confidence.

-

Relative to disposable income, we project household indebtedness to rise from its current level of 174 per cent to reach and then stabilise around 180 per cent of disposable income by the end of 2018.

The report projects higher levels for DSR over the medium term.

You can read the summary notes here, or download the full report here.