A new report by the Canadian Centre for Policy Alternatives titled Addicted To Debt: Tracking Canada’s Rapid Accumulation of Private Sector Debt warns that Canada is at risk of ‘serious economic consequences’.

The report says that:

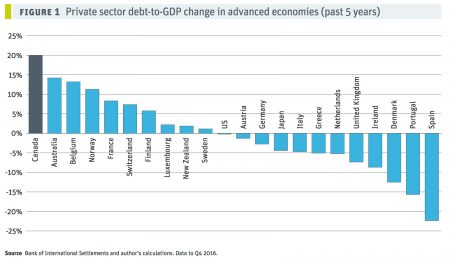

…for the first time ever, Canada’s private sector is racking up debt faster than any other of the world’s 22 advanced economies, putting the country at risk of serious economic consequences.

The report reveals that Canada added $1 trillion in private sector debt over the past five years (in 2016 dollars), with the corporate sector responsible for the majority of it. The study concludes that weaning the country off private sector debt should be our primary public policy concern, and recommends further study of corporate debt and consideration of a housing speculators’ tax to further reign in mortgage debt increases.

The report’s author, David Mcdonald is a Senior Economist with the Canadian Centre for Policy Alternatives. The report summarized the main risk for Canada:

Canada has never before led advanced economies in private debt accumulation. The closest it has come was third place in the early 1990s, just as real estate prices plummeted and stayed down for a decade.

Aside from the speed of its accumulation, Canada’s private debt at 218% of GdP is very high — the eighth highest of advanced countries today. For comparison, in September 2008 Canada’s ratio was 168%, essentially equal to the United States’ ratio of 169%, just as Lehman Brothers collapsed almost taking the entire financial system with it. This puts Canada in the danger zone of having both a high private debt to GdP ratio (over 150%) and rapid debt accumulation (more than 17% in the past five years). If the rate of growth of our private debt slows even a small amount, it will immediately have outsized impacts on our economy and asset markets. Canada is presently the only advanced economy running such a risk.

You can read or download the full report here.