Consumer insolvencies in BC decreased overall in April 2017 by a whopping 23.9 percent from March 2017. Consumer proposals decreased 26.5 percent while bankruptcies decreased 20.5 percent.

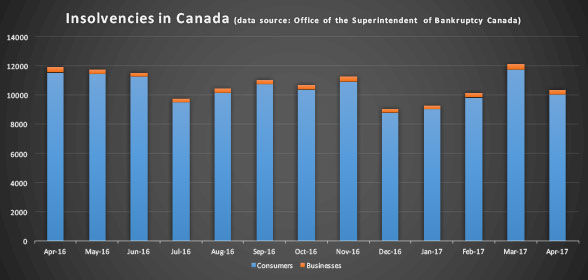

The proportion of proposals in consumer insolvencies in BC accounted for 53.7 percent during April 2017 while they accounted for 49.66 percent for all insolvencies across Canada for the same period.

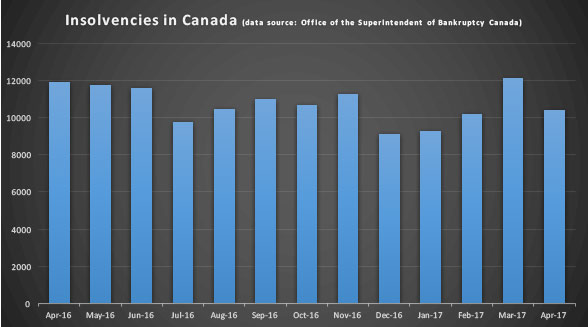

Consumer insolvencies in BC for the 12-month period ending April, 2017, decreased by 19.9 percent compared with the 12-month period ending April 2016. Consumer bankruptcies decreased by 16.6 percent, while consumer proposals decreased by 22.5 percent. Consumer insolvencies in all of Canada are up by 0.5 percent over the same period last year.

The proportion of proposals in consumer insolvencies in BC was 56.9 percent during the 12-month period ending April 2017, up from 53.25 percent during the 12-month period ending April 2016. It indicates the popularity of consumer proposals as a way for consumers to deal with their debt and with dealing with a Licensed Insolvency Trustee over other unregulated service providers.

The insolvency statistics indicate the increasing benefits of the protections provided to consumers under the Bankruptcy and Insolvency Act over other non-legislated options, whether that is a consumer proposal or a bankruptcy. It also indicates that consumers are seeing the benefits of seeking the professional advice of a Licensed Insolvency Trustee rather than those of other non regulated service providers.

If you would like to know exact details of how a consumer proposal or a bankruptcy would benefit you in dealing with debt, call us at (604) 605-3335 to schedule a free consultation.

Call us. It’s not too late.

See this article for other Canadian insolvency stats for April 2017.