There has been considerable debate as to whether an individual needs an independent debt advisor to file a consumer proposal to “protect” the interest of the debtor and get the lowest consumer proposal possible.

Quite often the discussion boils down to the fees of the LIT. The argument is that the LIT doesn’t represent the debtor’s best interests as they get paid more if the debtor pays more. The underlying theme is that the LIT wants you to pay as much as you can to obtain a higher fee. Hence, they say that the LIT is in a conflict of interest.

It has also been suggested that at the initial meeting the debtor might provide information to the LIT that could possibly be used to obtain a larger amount for the creditors, and thus greater fees for the LIT or that going to an LIT without a debt advisor is like being unrepresented in Court. In my experience, I can’t think of one situation where that would apply.

Other arguments include that independent representation is needed to protect assets without having to also worry about your creditors. Assets are either exempt pursuant to provincial legislation or they are not. There should be nothing to hide.

There have been comments that it costs $1,500 to file a consumer proposal. Not true. Most LITs require an up front payment, but typically not anywhere near $1,500.

Frankly, none of these assertions could be further from the truth.

Let’s look at the facts:

- An LIT is an Officer of the Court and is required to balance the interest of all stakeholders and be objective.

- The Assessment Directive issued by the Office of the Superintendent of Bankruptcy (“OSB”) provides that the LIT shall provide a complete assessment of the debtor’s affairs including assets, liabilities and income AND explain all the options available to the debtor for dealing with their debt. There is your independent assessment.

- The fees that are paid to the LIT are set by the Government of Canada through the OSB. So the Trustee hasn’t set the fees. The LITs fees are a byproduct of an accepted proposal. Every LIT gets paid the same in a consumer proposal. And if the LIT is banking on more fees, then objectivity has been lost.

- The creditors are the ones that vote on the proposal. The LIT has no say in the outcome.

- The LIT is best positioned to know what creditors want by reason of their experience in administering consumer proposals since 1991. That experience leads us to tell the debtor what may or may not work.

- The LIT is governed by a Code of Ethics by both its regulatory body, the Office of the Superintendent of Bankruptcy and its professional association, the Canadian Association of Insolvency and Restructuring Professionals (“CAIRP”).

If you have nothing to hide and want a proposal to be accepted to bring certainty to your situation, then you are best served by an LIT and no one else.

The insolvency process is about full and frank disclosure to your creditors. If you want your creditors to take a discount on what you owe them, then you need to be prepared to make full disclosure of your situation. By not disclosing everything to your LIT might mean that they would have changed their advice to you. As well, any proposal that is obtained by fraud or fraudulent means can be annulled.

Lastly, if you don’t do anything wrong, you won’t get in trouble.

LITs have been administering consumer proposals since 1991 and nowhere has it been stated, by the OSB or other stakeholders that LITs are in a conflict. The very nature of the role is that of conflict as we answer to many stakeholders. But we carry out these duties every day without any one complaining.

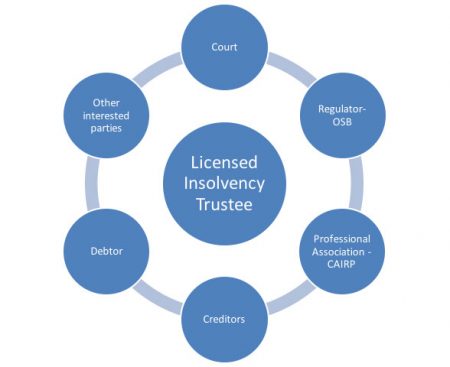

We have illustrated the nature of our role below;

As is apparent, we answer to many stakeholders.

What you need to make a fair and reasonable proposal to your creditors is the expertise of an LIT who will treat you fairly and give you the straight goods.

The experienced professionals at Boale, Wood & Company Ltd. understand the stress that financial difficulty can cause.

We know that realizing that you are experiencing financial problems is a hard thing to do for most people and sometimes you feel helpless. But instead of feeling helpless, let us help you gain control of your debts and understand your options.

Start by scheduling a meeting with us to discuss the solution best suited to your situation. This meeting is free and there is no pressure or obligation for you to make a decision right away.

We have the expertise to find the solution best suited to you.

Call us, it’s not too late. (604) 605-3335.