Consumer insolvencies in BC increased in November 2018 overall by 1.0 percent from November 2017. Consumer proposals increased 6.7 percent while bankruptcies decreased 7.7 percent.

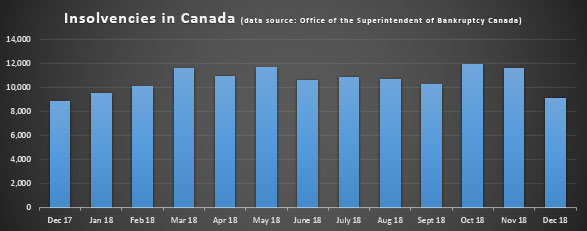

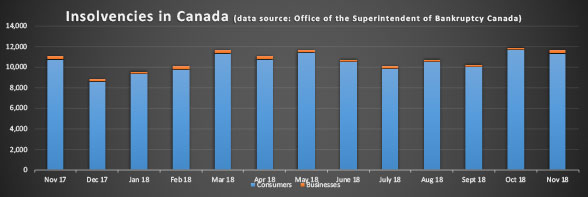

Consumer insolvencies in all of Canada increased 5.1 percent over the same period last year. BC accounted for 7.92 percent of all insolvencies in Canada in November 2018.

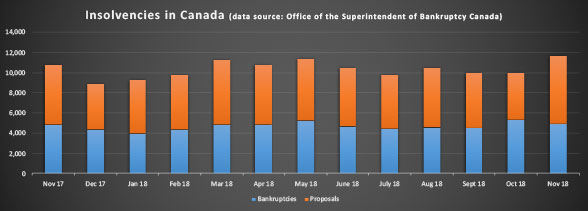

The proportion of proposals in consumer insolvencies in BC accounted for 63.73 percent during November 2018 while they accounted for 58.93 percent for all insolvencies across Canada for the same period.

The proportion of proposals in consumer insolvencies in BC was 59.68 percent during the 12-month period ending November, 2018, up from 57.99 percent during the 12-month period ending November 2017. It indicates the popularity of consumer proposals as a way for consumers to deal with their debt and with dealing with a Licensed Insolvency Trustee over other unregulated service providers.

While insolvencies across Canada are down overall by 5.1 percent, bankruptcies are down 3.6 percent, but proposals are up by 12.1 percent. Proposals also make up 55.67 of all insolvencies in Canada in 2018 up from 52.4 percent in the previous twelve months.

The insolvency statistics indicate the increasing benefits of the protections provided to consumers under the Bankruptcy and Insolvency Act over other non-legislated options, whether that is a consumer proposal or a bankruptcy. It also indicates that consumers are seeing the benefits of seeking the professional advice of a Licensed Insolvency Trustee rather than those of other non regulated service providers.

If you would like to know exact details of how a consumer proposal or a bankruptcy would benefit you in dealing with debt, call us at (604) 605-3335 to schedule a free consultation.

Call us. It’s not too late.

For more on the the all Canada statistics, see this page.