Consumer insolvencies in BC increased in September 2022 overall by 33.5 percent from September 2021. Consumer proposals increased 52.9 percent

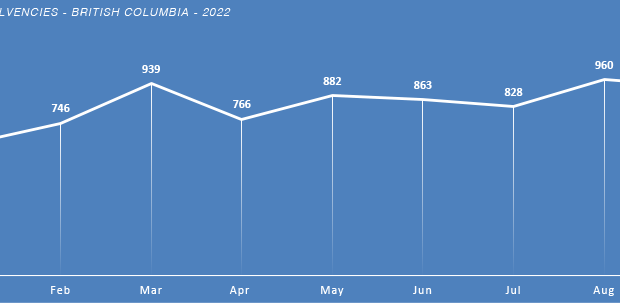

A Closer Look at August 2022 Insolvency Stats

Consumer insolvencies in BC increased in August 2022 overall by 33.4 percent from August 2021. Consumer proposals increased 44.0 percent while

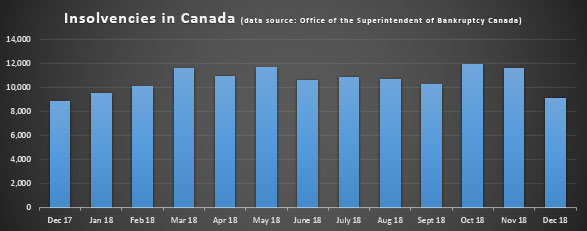

A Closer Look at November 2018 Insolvency Stats

Consumer insolvencies in BC increased in November 2018 overall by 1.0 percent from November 2017. Consumer proposals increased 6.7 percent while

Canadian Insolvency Stats for November 2018

The latest numbers from the office of the Superintendent of Bankruptcy Canada shows a 2.5% percent decrease in the total number of insolvencies in

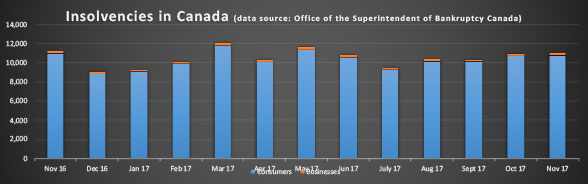

A Closer Look at December 2017 Insolvency Stats

Consumer insolvencies in BC decreased in December 2017 overall by 15.0 percent from November 2017. Consumer proposals decreased 13.6 percent while

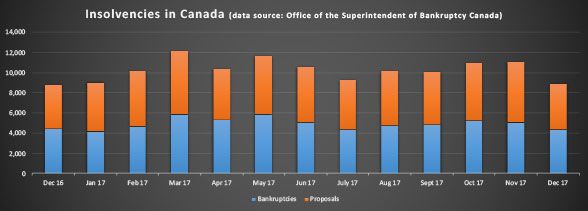

A Closer Look at November 2017 Insolvency Stats

Consumer insolvencies in BC increased in November 2017 by 14.7 percent from October 2017. Consumer proposals increased 11.7 percent while

Canadian Insolvency Stats for November 2017

The latest numbers from the office of the Superintendent of Bankruptcy Canada shows a 0.9% percent increase in the total number of insolvencies in