BC Court confirms single date approach to discharging Student Loans through a consumer proposal or bankruptcy. A recent decision by the BC

Comparing Consumer Proposal to a Debt Management Program

In Canada, one of the most common, if not the most common, debt relief program is a Consumer Proposal. Other debt relief programs, commonly

A message regarding COVID-19

Dear clients and friends of Boale, Wood & Company Ltd. As you all are aware, the World Health Organization (“WHO”) recently declared the

I Owe CRA a Lot of Money and I Can’t Pay

Now What? When you owe the government money, it can be overwhelmingly stressful. It doesn’t matter if it is for taxes, student loans or even Medical

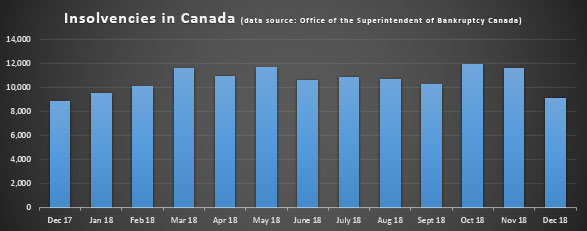

A Closer Look at November 2018 Insolvency Stats

Consumer insolvencies in BC increased in November 2018 overall by 1.0 percent from November 2017. Consumer proposals increased 6.7 percent while

Canadian Insolvency Stats for November 2018

The latest numbers from the office of the Superintendent of Bankruptcy Canada shows a 2.5% percent decrease in the total number of insolvencies in

Financial Stress!

What are my Options? Do any of these situations seem familiar? You’re being faced with ongoing telephone calls from your creditors harassing you;

Financial Options Explained

Communicate with your creditors and find a plan to pay everybody in full. Often the best solution is communication. Everybody feels a little

Canadian economy facing deep-rooted problems as wages stagnate, household debt mounts

Headline: Canadian economy facing deep-rooted problems as wages stagnate, household debt mounts: Wages are barely keeping up with the cost of living,