In Canada, one of the most common, if not the most common, debt relief program is a Consumer Proposal. Other debt relief programs, commonly

How Do I Go About Having My Bankruptcy Annulled?

There are three ways that a bankruptcy can be annulled. Firstly, if you are able to pay your debts in full due to receiving a windfall, then your

Should I file a Consumer Proposal or proceed with a Debt Management Plan

A consumer proposal is often compared and contrasted with a program provided by credit counselling agencies known as a debt management plan. While

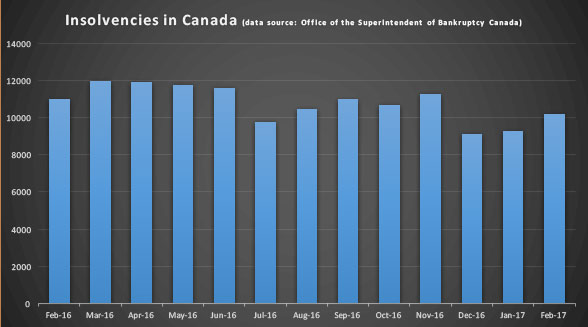

A Closer Look at Insolvency Stats – Feb 2017

Consumer insolvencies in BC increased overall in February 2017 by 3.5 percent from January 2017. Consumer proposals increased 8.5 percent while

File Your Income Tax Return, You Might Get Money Back

Did you know that just by filing your income tax return, you could receive more money from the federal and provincial governments through tax credits

Death and Financial Problems. What to do?

What do you get when you have the premature death of a spouse who leaves behind a substantial amount of debt? There are several misconceptions

Economist Says Millennials Financial Future Threatened by High House Prices

Scottish professor and economist Duncan McLennan is one member of an international panel coming to Vancouver to speak at the re:address

Canadians living pay cheque to pay cheque

Almost half of Canadians are living pay cheque to pay cheque, and residents of British Columbia are the most cash strapped in the country, according

The Notice of Intention to Make a Proposal

The Bankruptcy and Insolvency Act (BIA) allows insolvent persons to benefit from a 30-day grace period to perform a financial restructuring. This is